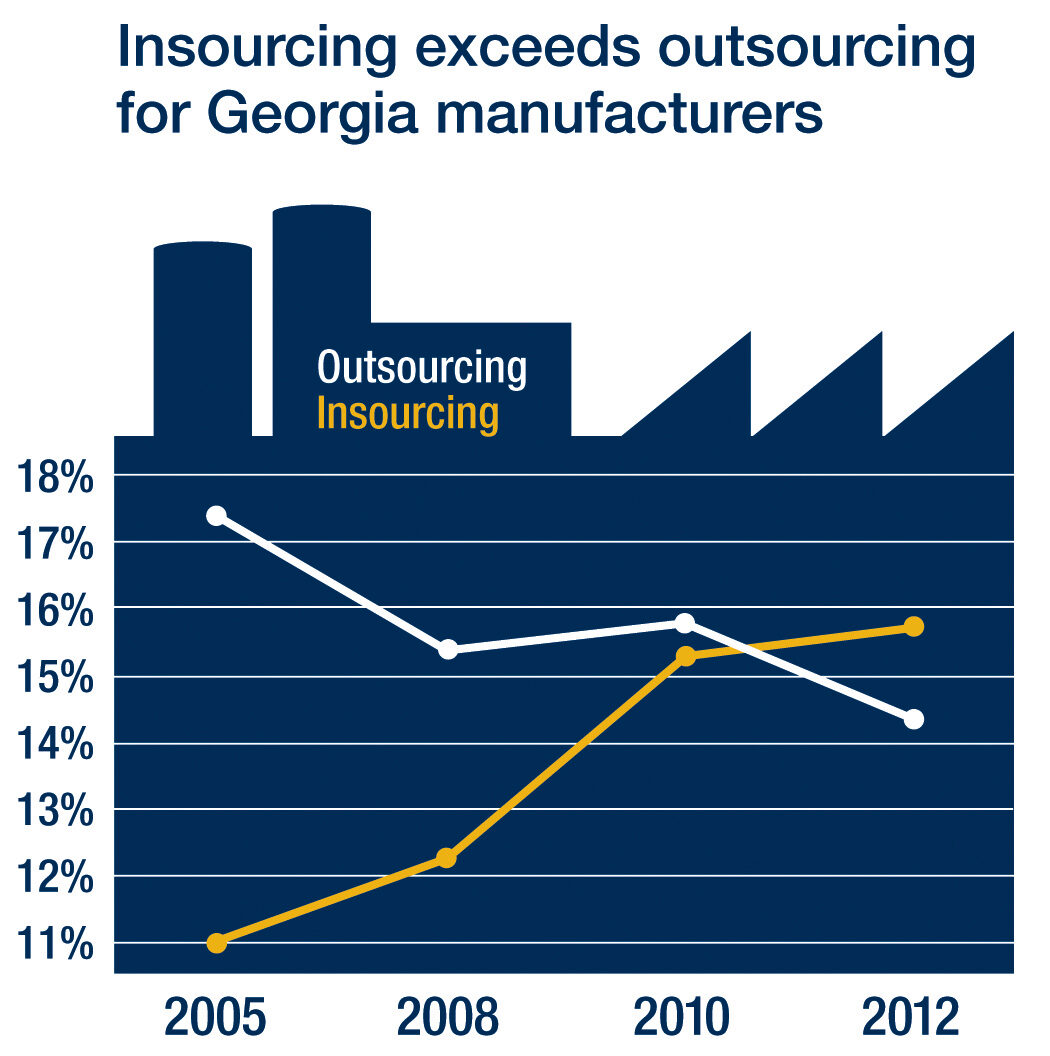

Nearly 16 percent of the companies responding to the survey said work had been transferred to them from outside Georgia, compared to slightly more than 14 percent that lost work to out-of-state facilities. The percentage of companies receiving work from facilities outside Georgia grew from just 11 percent the first year the question was asked in 2005, while the percentage of companies losing work fell from slightly more than 17 percent.

“We have finally seen a crossing of the lines so that more companies are benefiting from in-sourcing than are losing to outsourcing,” said Jan Youtie, director of policy research services in the Enterprise Innovation Institute at the Georgia Institute of Technology. “It’s not a huge difference at this point, but it is a positive and consistent trend for the manufacturing community.”

The in-sourced work most commonly came from other facilities in the United States, though a growing percentage of companies reported production transferred to them from outside the United States. The percentage of companies benefitting from this “on-shoring” trend grew to 4.3 percent from 2.6 percent in 2005.

“This may be about the total cost of manufacturing,” said Youtie, who also holds a faculty position in the Georgia Tech School of Public Policy. “Companies are taking a hard look at aspects of production they formerly assumed were cheaper overseas. There are costs involved in outsourcing that may not have been considered before, such as logistics and regulatory issues. Rising foreign labor costs may be another factor.”

Technology-driven companies and those that compete on the basis of innovation are more likely than other firms to benefit from in-sourcing. Larger companies are somewhat more likely to receive work from outside the state than are smaller firms. In some cases, companies both gained work from outside Georgia and lost work to outside facilities.

“The growing need for new technology has also created an interesting convergence between different sectors in Georgia’s manufacturing industry,” said Adam Beckerman, partner-in-charge of the manufacturing and distribution group at Habif, Arogeti & Wynne, LLP. “For example, a piece of robotic equipment that is being used to attach car doors at an automotive production plant happens to be the same equipment that is being used to hold chickens at a nearby food production facility. In coming years, we will see more of these multi-purpose technologies and pieces of equipment having a positive impact on various sectors of the manufacturing industry.”

The Georgia Manufacturing Survey is conducted every two or three years to assess the use of modern manufacturing technology, practices and techniques by Georgia industry. It was conducted by Georgia Tech researchers in collaboration with Kennesaw State University, the Georgia Department of Labor, and the Atlanta accounting firm Habif, Arogeti and Wynne, LLP, a Georgia-based tax, accounting and business advisory firm. The 2012 survey was conducted from February to May of 2012, and received responses from 528 companies that had 10 or more employees.

The survey also asked about a broad range of competitiveness and productivity issues, and focused on current and planned technology use. More than half of the respondents reported using enterprise resource planning, computer-aided design and preventive-predictive maintenance technology. Inventory-focused technologies such as bar-code readers and radio-frequency identification (RFID) systems led the list of future priorities, with 21 percent of companies planning to purchase readers and 18 percent planning RFID investments.

While industrial robots have captured public attention, they aren’t high on the shopping lists of Georgia companies. About 13 percent of the firms surveyed use robots now, but only 5 percent say they plan to add them. About 9 percent of companies employ advanced materials in their manufacturing, while approximately 6 percent use additive manufacturing – technology for building parts directly from computer-aided design systems.

Although concerns are raised about the role of technology in reducing manufacturing employment, the Georgia Manufacturing Survey did not find a strong relationship between technology adoption and employment decline. Manufacturers using production technologies and techniques were more than 40 percent more likely to have added employment rather than to have reduced employment. A model that controls for sales, capital, industry, year of establishment and other factors found that greater technology use is positively associated with higher employment, noted Phil Shapira, co-director of the survey and a professor in Georgia Tech’s School of Public Policy and a professor of innovation, management and policy at the University of Manchester in the United Kingdom.

“One caveat is that the model does not represent manufacturers that went out of business due to technological or other factors,” he said. “That said, job losses related to technology substitution may have been offset by employment gains due to greater competitiveness.”

Though many companies responding to the 2010 survey said they were interested in sustainability, that didn’t translate into dramatic action in the 2012 survey. For instance, only 8 percent of Georgia manufacturers have produced an emissions inventory or carbon footprint of their facilities.

“We saw that companies followed through on plans for waste elimination and efforts to reduce pollution, but we didn’t see an increase in the re-use of materials, remanufacturing, less shipping or more use of renewable energy,” Youtie said. “The basic entry points for sustainability are there, but some areas haven’t seen much progress.”

As in past years, the study compared profitability of companies with different competitive strategies. The return on sales for companies competing on the basis on innovative products, processes or services was twice that of companies competing on the basis of low price. Innovative companies also pay higher wages than companies using other strategies.

“We see that science-based industries are more likely to prioritize innovation as a strategy,” explained Shapira. “Industries such as food and apparel are less likely to compete that way. No group has a large percentage of firms competing on innovation, though companies in any industry can use innovation.”

Seventeen percent of Georgia manufacturers chose low price as their primary competitive strategy, compared to less than 10 percent that compete through innovation or the use of new technology. The most popular competitive strategy was high quality.

Other survey findings included:

- Half of Georgia manufacturers reported export sales, and 23 percent of respondents reported that their exports increased in 2011 over 2009 levels.

- Profits of Georgia manufacturers generally declined between 2010 and 2012, but the profitability difference between companies competing through innovation and those competing on the basis of low price remained.

- When Georgia manufacturers conduct research and development activities, they compared well with manufacturers across the country. However, only a third of Georgia manufacturers conducted R&D in-house, and only 4 percent used public loans or grants to pay for R&D. Less than 20 percent of companies used R&D tax credits available through state and federal sources.

The results show the challenges facing Georgia manufacturers.

“Innovation, advanced technology and sustainability play crucial roles in helping manufacturers achieve competitiveness and maintain it for the future,” the authors wrote. “Manufacturers increasingly must operate using efficient and productive technologies, and with finite resources and greater awareness of environmental impacts.”

Research News & Publications Office

Georgia Institute of Technology

Media Relations Contact: John Toon (404-894-6986)(jtoon@gatech.edu)